avalara tax codes mapping

53 - Mapping Items to TaxCodes. Sales and use tax determination and exemption certificate management.

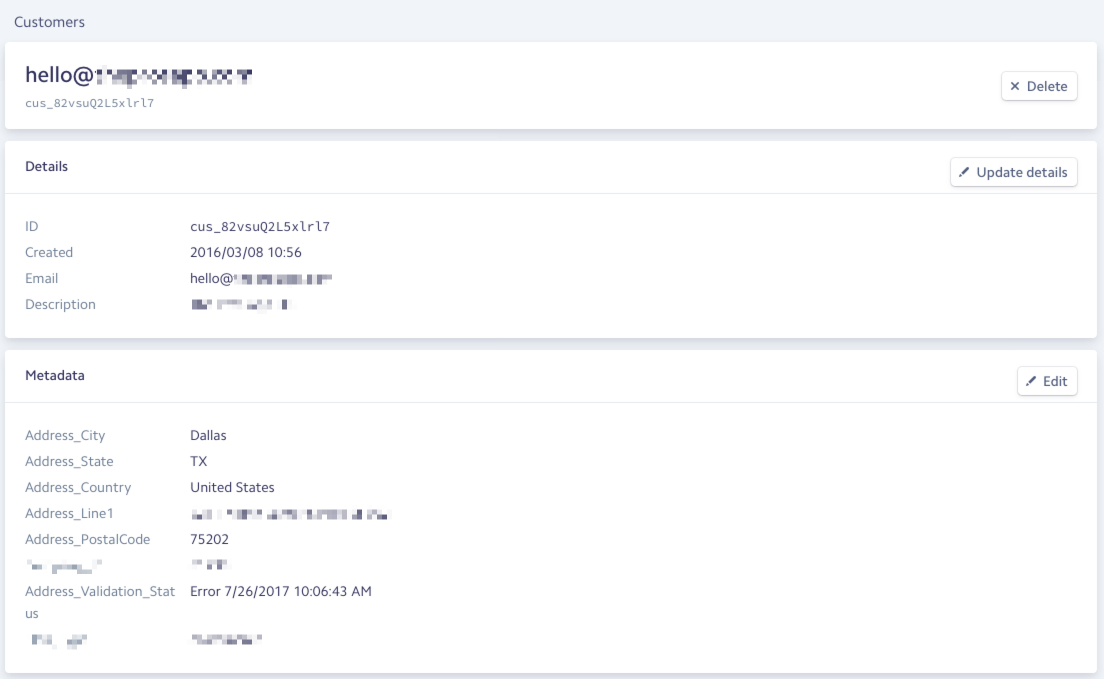

Stripe Connector For Netsuite Handling Taxes With Stripe Netsuite

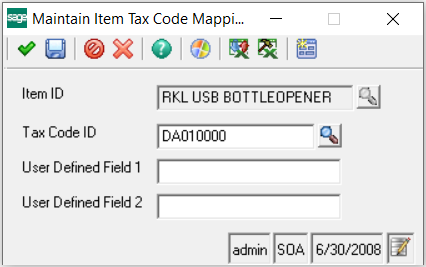

Most Avalara tax codes are made up of eight characters.

. Unposted Expenses are not Syncing when the Ticket where the Expense Records is not Close. On the What You Sell page select the checkboxes next to the items you want to map to the same Avalara tax code and then click. In AvaTax go to Settings What You Sell.

Mapping tax codes to products using Webgility is optional. Verify Avalara calculated Tax Amount is used in. Server audit clarity and installation.

Verify Avalara calculated Tax Amount is. The first letter indicates the tax code type P for products D for digital Fr. Marketplace facilitator tax laws.

Verify Avalara calculated Tax Amount is used in transaction. AvaTax tax code mapping - Item codeSKU. Known Issue - 20204 - Failed to Retrieve Tax Code when Tax Code is NULL.

AvaTax tax code mapping - Item codeSKU. In AvaTax go to Settings What You Sell. Two letters to start and six numbers at the end.

Server audit clarity and installation. Marketplace facilitator tax laws. Sales and use tax determination and exemption certificate management.

Create the import file using the item and tax code. Communications Enterprise Support Services. Once you have added the.

Tax code mapping group. Returns preparation filing and remittance. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell.

If you leave the product code blank then Avalara AvaTax assigns the default. Demonstrate and document installation of software. Again you should be using the list of Product Tax Codes that Avalara has predefined so that you are taking full advantage of their tax calculation engine.

AvaTax for Communications AFC uses a system of numbers to represent the Transaction Types and Service Types for the service you wish to tax. Returns preparation filing and remittance. Common Transaction and Service type mapping scenarios in AvaTax for Communications.

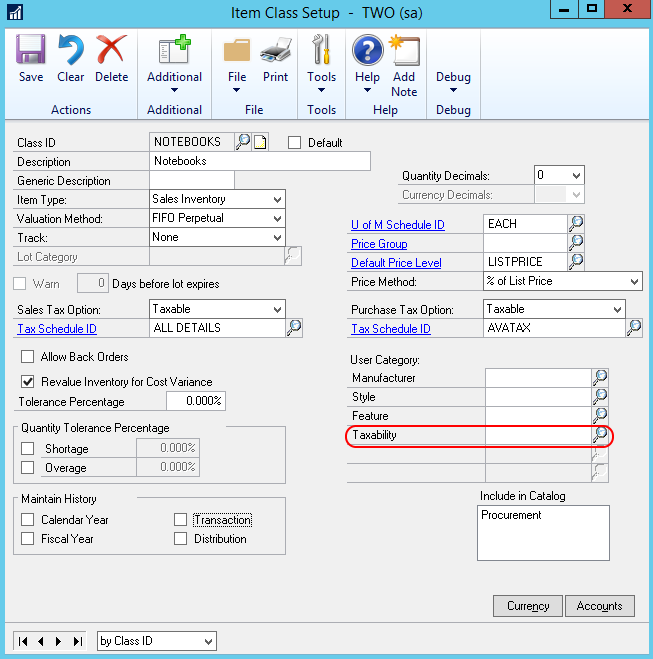

Steps In AvaTax go to Settings What You Sell. To begin this process go to the tools menu heading and select avalara then select product tax code. Some customers prefer to go further - to actually create a product catalog and use AvaTaxs ItemCode feature to classify their products and link them.

Tax code mapping group. Download the Item Import toolkit and the Avalara tax code list. Tax code mapping should be done within the active company in the Avalara AvaTax account as tax code mapping in.

Avalara Self-Serve Tariff Code Classification is an intuitive AI-enabled tool that allows you to easily determine codes and requires no prior experience in HS classification. Tax code mapping group. You can copy and paste a code you find here into the Tax Codes field in.

On the What You Sell page select the checkboxes next to the items you want to map to the same Avalara tax code and then.

Sales Tax Datalink Vs Avalara Sales Tax Data Link

Create Your Avatax Tax Code Agency And Vendor Avalara Connector For Netsuite Youtube

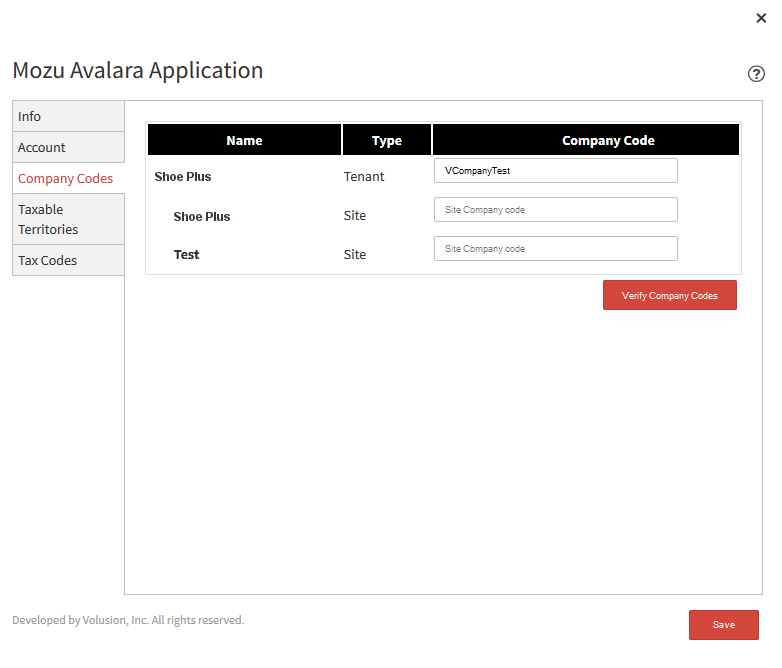

Avalara Application By Kibo Ecommerce

What Is Avatax Ins And Outs Of Avalara Sales Tax Software

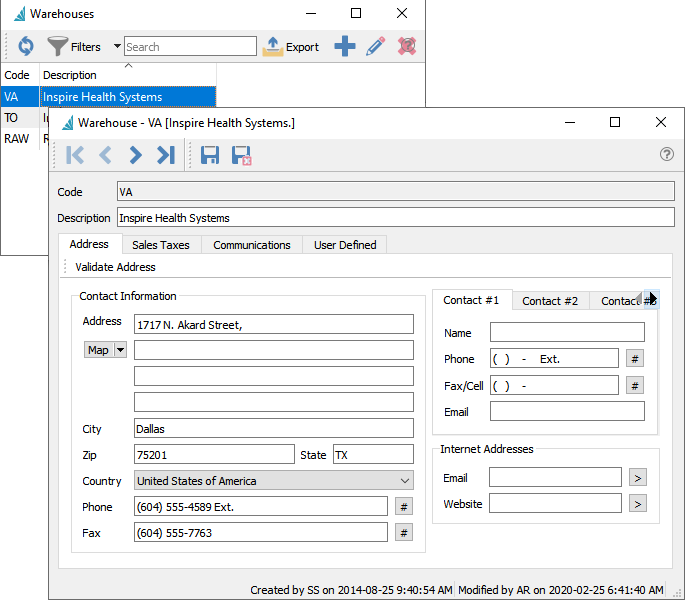

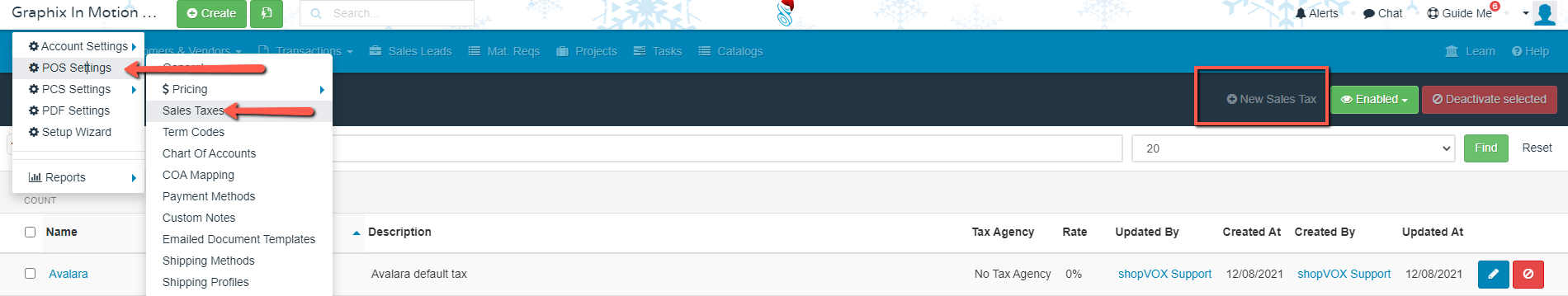

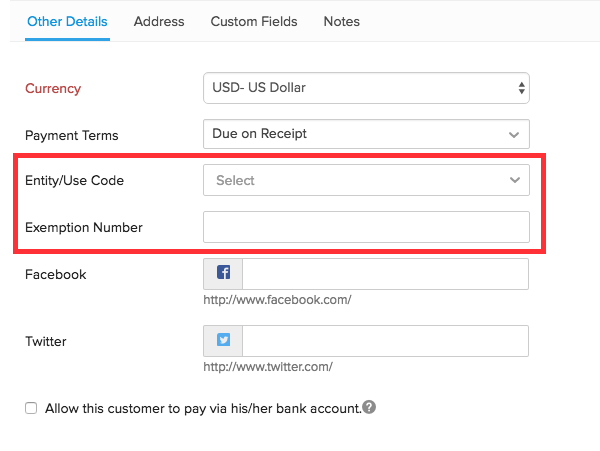

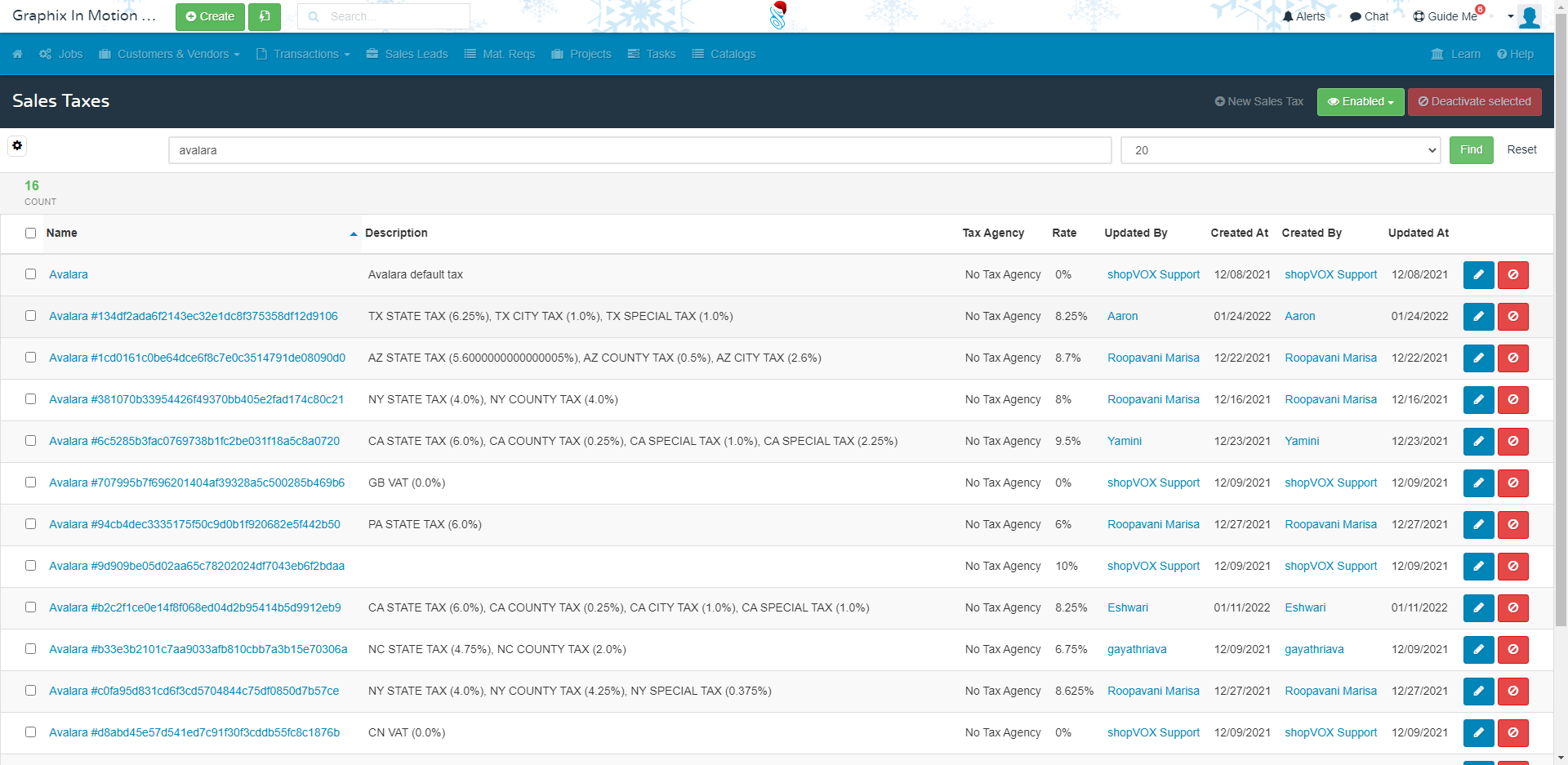

Avalara Avatax Sales Tax Setup Guide Shopvox Help Center

Understand Sales Tax Holidays In Avatax Avalara Help Center

Product Business Partner And Freight Taxability With Avalara In Sap Business Bydesign Sap Blogs

Avalara Avatax Integration Help Doc Zoho Subscriptions

Known Issue Multi Level Tax Code Mapping When Avalara Enabled Wise Sync For Connectwise Manage

Avalara Avatax Sales Tax Setup Guide Shopvox Help Center

Woocommerce Avatax Woocommerce

Customer Exemption And Product Tax Types In Avalara Brightpearl Help Center

Sync Avalara Taxcode To Shopify Tax Code Field Celigo Help Center